LIQUIDITY PROVISIONING

Growing Digital Asset Exposure by Capitalizing on Volatility and Trading Fees

NON-CUSTODIAL AND TRANSPARENT VAULTS

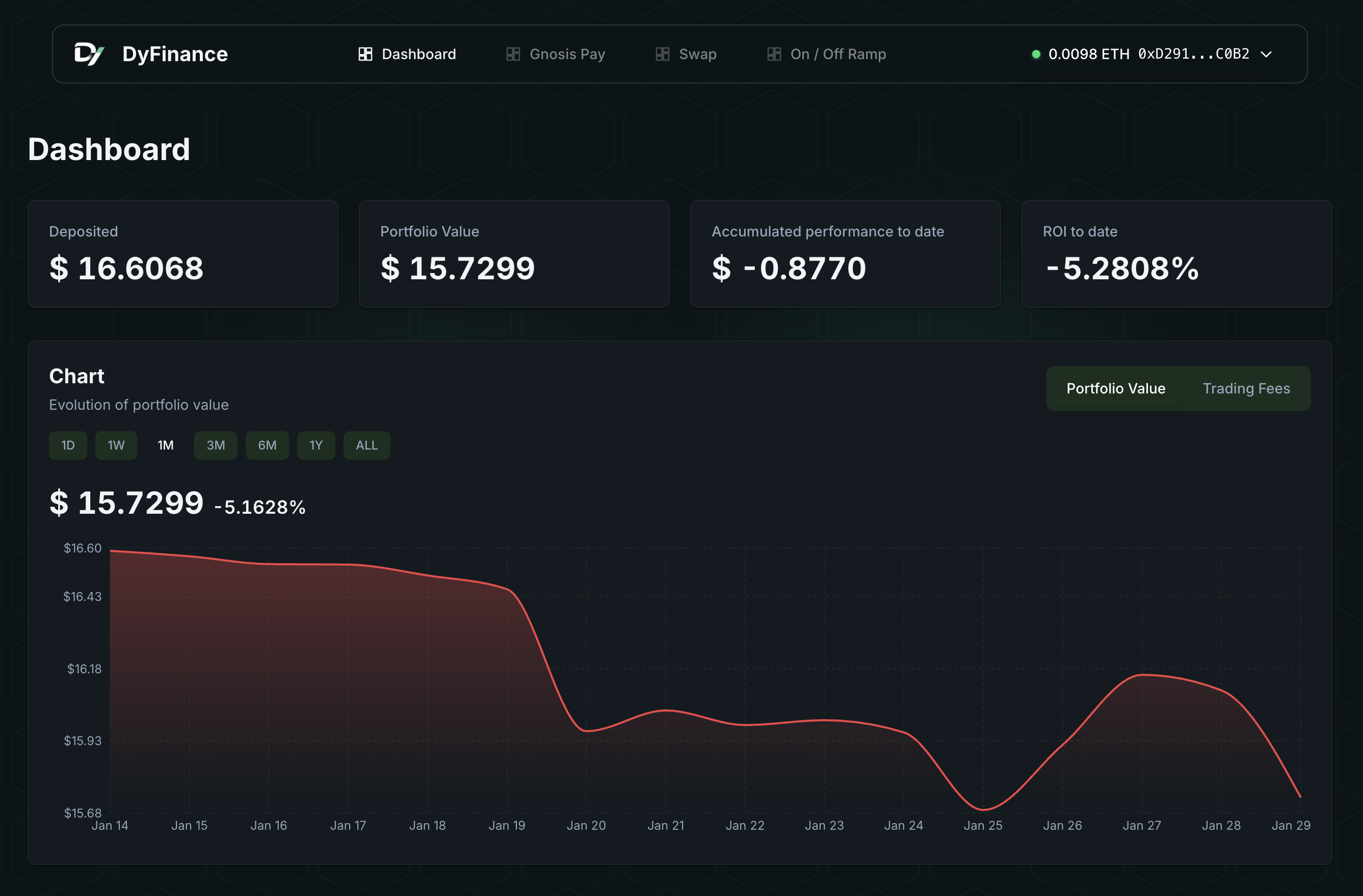

Optimize capital accumulation with automated strategies. Track fees, IL, and P&L in real-time.

Transparent

Real-time tracking of fees, impermanent loss, and P&L. Complete on-chain transparency.

Performant

Optimal strategy for long-term holders. Automated rebalancing without active management.

Secure

Non-custodial vaults (ERC-7540). You maintain full ownership of your assets.

Simple

Seamless access and navigation. Deposit USDC and let automation handle the rest.

Strategy highlight

Liquidity provisioning (or LPing) involves depositing a pair of tokens into a liquidity pool on a decentralized exchange. The liquidity pools use smart contracts to enable permissionless, on-chain trading. Liquidity providers (LPs) earn fees or other rewards.

Sweet spot between:

Optimized long-term capital accumulation without active management

Trading fees will be absorbed by pool liquidity in the provided price range of the trade

Frequently Asked QUESTIONS

Everything you need to know about liquidity provisioning vaults

Liquidity provisioning (or LPing) involves depositing a pair of tokens into a liquidity pool on a decentralized exchange. The liquidity pools use smart contracts to enable permissionless, on-chain trading. Liquidity providers (LPs) earn fees or other rewards.

The liquidity provisioning doesn't come without risks. The main risks include: market risk/volatility, smart contract risk, impermanent loss risk and operational risk.

Prospective users can request additional information by submitting the following form. The team will subsequently contact them using their preferred channel.